Create an Impact with Your Donation

Every donation made helps AFLEP continue its mission toward creating thriving communities through New Mexico.

AFLEP’s North Central Regional outreach project continues its success by becoming an integral part of many local communities and inspiring organic change from within. This is all thanks to YOU and your continued support of our mission..

Here is our video about an farm cooperative in Central New Mexico which provides food, trains new farmers, and incubates businesses. The participants discuss the financing challenges faced by farmers and small businesses today. A Public Bank in New Mexico could be a vital resource to invest in local food production, job creation which in turn would create a stronger local economy and community well-being.

Endorsements a Public Bank for New Mexico

You can also endorse a public bank so public officials and friends know you support public banking and why.

Endorsements from community members and leaders across New Mexico are extremely helpful to us, as we speak with Legislators – to show the growing support for public banking. View Full Endorsers Gallery >>>

Allied Organizations that support what a State Public Bank can do for our economy

New Mexico News

House Commerce and Economic Development Committee at 1:30 on Wednesday, February 5, 2025.

Friday, January 17 at 8:00 a.m. our Executive Director, Angela Merkert was featured on an hour-long radio interview with the public radio station in Silver City on The Forum with lead interviewer, Raul Turrieta, a board member and community leader in Silver...

2025 Legislative Preview Zoomfest – Top of the List

National News

A Bank of One’s Own

In a recent article published by Non Profit Quarterly regarding Economic Democratic Weekly, it is clear that there is more legislative activity and public bank formation is underway in California, New York and other areas in the States. The focus is clearly on keeping...

CFO Patronis Proposes ‘Sunshine Freedom Bank,’ A First-of-its-Kind State Bank of Florida

TALLAHASSEE, Fla. — Today, Chief Financial Officer (CFO) Jimmy Patronis proposed the “Sunshine Freedom Bank,” a public bank of Florida that would establish state control over state funds. The Florida Treasury, which CFO Patronis...

Banking For The People: New E-book by Next City & CommonFuture

by Next City & CommonFuture — Our mainstream banking system is failing most of us. This ebook includes stories about the people and organizations working to make the system work better for everyone — no matter their race, zip code or socioeconomic status. It’s not...

Retake Our Democracy Zoominar Panel on Public Bank Legislation

Retake Our Democracy Zoominar Panel on Public Bank Legislation

We had a great discussion panel with Retake our Democracy ahead of the 2023 Legislative session. October 26, 2022

Albuquerque local business consultant on how a State Public Bank can benefit our economy

Albuquerque local business consultant on how a State Public Bank can benefit our economy

AFLEP Leadership Team Member and Albuquerque”buy local” business advocate, Clifton Chadwick shares key economic reasons why he supports the creation of a State-Owned Public Bank. March 10, 2022

SEED NM 2022 Symposium: Bob Mang on how business guilds can regenerate communities

SEED NM 2022 Symposium: Bob Mang on how business guilds can regenerate communities

Bob Mang, Re-Genesis Inc, Co-Founder (Retired) and AFLEP Board member, talks about rural economic development and how business guilds can regenerate communities.Jan 14, 2022

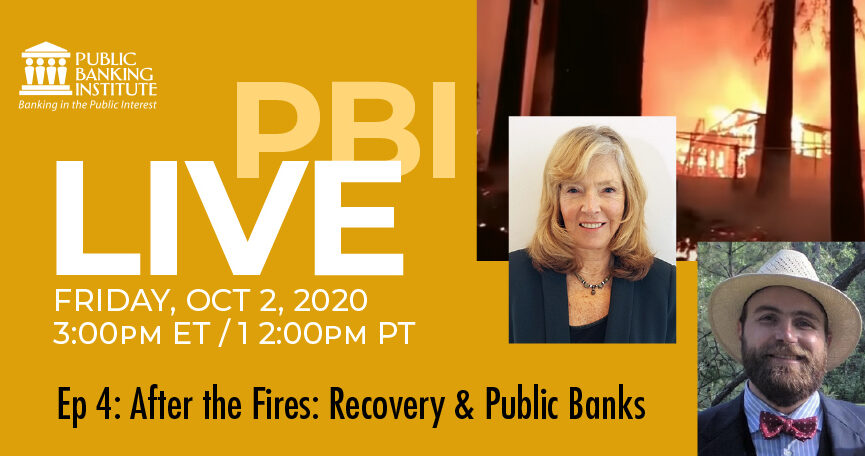

Public Banking Institute

Accross the nation, more than 25 initiatives and 50 grassroots organizations are advocating for the chartering of public banks. Learn more about the National Movement and the work of our national affiliate, the Public Banking Institute.

- North Dakota had the lowest unemployment rate in the nation during the 2007-08 recession. Current May 2023 rates: North Dakota, 2.1%; U.S., 3.7%; New Mexico, 3.5%.

- Bank of North Dakota (BND) has added to the state’s annual operating budget $300+ million over the past 10 years.

- North Dakota community banks are thriving because of their partnerships with BND: 10 community banks per 100,000 population, the highest in the U.S.

- Founded in 1919 with $2 million in capital, BND reported assets of $7.0 billion at the end of 2019, their 100th anniversary. In 2022, their assets were $10.2 billion.

- BND originated or renewed 15,696 loans to state businesses, projects and students, totaling $1.33 billion in their 100th year of 2019. Their total loan portfolio in 2022 was $5.4 billion.

- BND works actively to create successful new businesses to reduce the state’s dependence on oil and gas.

- BND responded to the COVID-19 crisis with confidence in 2020, filling the gaps that federal programs didn’t support and seeing a 15% Return on Investment (ROI). Their ROI in 2022 was 19%.

Detailed Comparison of New Mexico and North Dakota

BND’s 2020 Economic Development Report: Creating Financial Solutions for Current and Emerging Economic Needs

BND 2022 Annual Report: Game Changer